The Effect of the Minnesota Alternative Minimum Tax on Household Filers

1. Introduction

The Minnesota Timberwolves beat the Denver Nuggets last Monday night 106-80 in Game 2 of the NBA Western Conference Semifinals. The Timberwolves’ defense holding the Nuggets to 80 points represented the minimum points that Minnesota allowed this season, both in the regular season and in the playoffs.1 In this article, we discuss another Minnesota minimum about which there is less consensus.2

Minnesota is one of only four states that currently have a state individual alternative minimum tax or state AMT (see Figure 1). Iowa had a state AMT up until the beginning of 2023, when it was repealed.3 The stated goal of the Minnesota AMT is “to ensure that anyone who benefits from certain tax advantages pays a minimum amount of tax”, focused primarily on high income tax filers.4 As we detail below, the AMT is much more complicated than a minimum tax liability level or percentage that a filer must pay. The Minnesota individual AMT really creates two separate and independent ways of calculating state income tax liability.

Given (i) the degree of extra complexity introduced by the Minnesota AMT, (ii) the small number of households to which it applies, (iii) the small amount of revenue it raises, and (iv) the child tax penalty it imposes, it is not likely that the Minnesota AMT would pass a cost-benefit test.

In this article, we show how the Minnesota state AMT affects many different types of household tax filers in the state. We run our simulations using the FiscalSim-US open source model of US federal and state individual income taxes and benefits. Our experiment is to simulate the standard (non-AMT) current law Minnesota individual income tax for a number of different types of state tax filers and show how much extra tax liability the state AMT adds to these filers. Because all of our modeling infrastructure is open source, we provide all of our code and source data in a way that is easy to replicate and customize.5

Figure 1. Four states with state alternative minimum tax (state AMT) as of May 2024

We find that Minnesota’s AMT does guarantee that middle-to-middle-high income taxpayers pay an increased minimum amount of tax by limiting certain deductions. However, this introduces significant complexity to the tax code. Additionally, Minnesota’s AMT only applies to a small portion of tax payers, and raises a relatively small amount of money. Even high income households will often not pay significantly higher taxes because the AMT tax is more dependent on the amount of deductions and dependent exemptions filed than on employment income.

However, the Minnesota AMT does impose a significant extra tax penalty for each additional child in Minnesota households for a wide range of middle-to-high incomes. And the state AMT extra tax can also be significant on households with large expenses that are deductible in the standard state tax liability calculation but are not allowed in the AMT calculation.

This article is organized in the following sections:

1. Introduction

Figure 1. Four states with state alternative minimum tax (state AMT) as of May 2024

2. Details of Minnesota’s Alternative Minimum Tax

3. Effects of Minnesota AMT on Minnesota tax filers

3.1. Scenario 1: MN tax filers, varying employment income and number of children

Figure 2. Minnesota AMT minus standard tax liability for married filers by employment income and number of children

Figure 3. Minnesota AMT minus standard tax liability for single filers by employment income and number of children

3.2. Scenario 2: Effect of increasing AMT-non-allowed deductions

Figure 4. Minnesota AMT minus standard tax liability for married filers by AMT-non-allowable deductions and number of children

Figure 5. Minnesota AMT minus standard tax liability for single filers by AMT-non-allowable deductions and number of children

4. Conclusion

Footnotes

2. Details of Minnesota’s Alternative Minimum Tax

The first federal alternative minimum tax was passed in 1969 as part of the Tax Reform Act.6 The minimum tax was passed as a response to high income households that were paying little to no income tax because of large subtractions from their taxable income or deductions. Tax filers would add a percentage of certain deductions and subtractions over a certain limit. In 1977, Minnesota enacted its first state alternative minimum tax that had a similar structure to the federal AMT.7

In 1982, the U.S. Congress passed the Tax Equity and Fiscal Responsibility Act, which changed the federal alternative minimum tax structure from its simple add-on original form to a requirement for some filers to calculate their taxes two different ways and pay the greater of the net liabilities.8 Minnesota passed state tax reforms in 1987, that similarly amended the Minnesota AMT.9 Instead of adding a portion of deductions to the final tax liability, the current minimum tax uses an alternative tax system with fewer deductions, subtractions and exemptions and different tax rates. Tax payers must compute their tax liability under both the normal tax system and the AMT system and pay the higher of the two.

There are some notable differences between the standard federal tax system and the federal AMT system. The standard deduction for the federal AMT is much higher. For a household that is married, filing jointly, the standard deduction for the AMT is $82,150 versus $25,800 under the standard non-AMT system. This ensures that the federal AMT will not affect lower income households. Only some itemized deductions are allowed under the federal AMT. For example, intangible drilling costs can not be subtracted from the federal AMT liability while charitable contributions and medical expense deductions still can. Lastly, after taxable income is calculated under the limited set of deductions and subtractions allowed in the AMT, it is taxed at 26% and 28% for income over $206,100, instead of using the 7 tax brackets under the normal tax code.10

Minnesota’s state AMT closely follows the federal AMT with some differences. Minnesota’s AMT does not allow dependent exemptions. This creates an effective penalty for children under the AMT. In addition, home mortgage interest is not deductible under the Minnesota AMT. Lastly, the Minnesota AMT uses a 6.75% flat tax. This is 6.75% marginal tax rate on all income under the Minnesota AMT structure has is a lower rate than the all Minnesota’s progressive marginal tax rates for any income over $41,050 for married filing jointly (6.80%, 7.85%, and 9.85%) in the Minnesota standard system. For this reason, many higher income taxpayers will often pay more under the normal tax system with the higher rates. The Minnesota AMT only applies to state tax filers for whom the AMT-excluded deductions are a big part of their tax filing.

Minnesota’s state AMT does not affect most tax filers in the state nor does it raise a lot of revenue. A 2017 white paper from the state House of Representatives forecast that Minnesota’s AMT would raise $23.6 million in the 2017 tax year from around 9,500 taxpayers.11 That is about 0.2 percent of Minnesota tax revenue from about 0.3 percent of registered Minnesota taxpayers.

3. Effects of Minnesota AMT on Minnesota tax filers

In this section, we look at the effect of income and deductions not allowed under the AMT and how they impact total tax liability. To do this, we model two separate scenarios of the difference between the tax liability computed under the Minnesota AMT and the standard Minnesota tax liability calculation. We refer to this difference as the “extra MN AMT above the standard tax liability”. Where the difference is zero, the calculated Minnesota AMT amount is less than the standard calculation tax liability. Where this difference is positive, the household pays the Minnesota AMT calculated tax liability as an extra amount above the standard calculated tax liability.12

3.1. Scenario 1: MN tax filers, varying employment income and number of children

In our first scenario, we look at the effect of number of dependent children on the extra MN AMT above the standard tax liability for a married couple filing jointly. As discussed in section 2, the Minnesota AMT calculation does not allow for the state dependent exemption of up to $4,800 for each child.13 In order to show the effects of the AMT, we model the net tax liability of a married household with $100,000 of AMT-non-allowed deductions (e.g. gambling-loss deduction or home mortgage interest deduction).

We use the FiscalSim-US open source microsimulation for federal and state income tax to show how different levels of before-tax employment income and number of children affect the extra Minnesota AMT above the standard tax liability. In Figures 2 and 3, we show the extra MN AMT above the standard tax liability for household employment incomes between $0 and $600,000, for married (Figure 2) and single (Figure 3) filers, and for number of child dependents between 0 and 6.

Figure 2. Minnesota AMT minus standard tax liability for married filers by employment income and number of children

Figure 3. Minnesota AMT minus standard tax liability for single filers by employment income and number of children

The first characteristic to note about the Minnesota AMT is that it works exactly as it was designed for all tax filers, adding extra tax liability for married filers with employment income between $82,150 and $543,000 and extra tax liability for single filers with employment income between $61,610 and $500,000. In this case of $100,000 of AMT-non-allowed deductions, the increased standard deduction under the state AMT calculation of $82,150 for married tax filers and $61,610 for single filers ensures that there is no extra state AMT liability for households with employment income under these respective standard deduction amounts.

At incomes for married and single filers above $543,000 and $500,000 in Figures 2 and 3, respectively, the standard tax liability calculation becomes greater than the state AMT calculation. This is because the standard calculation has a progressive schedule of marginal tax rates that exceed the flat 6.75% tax rate on taxable income in the state AMT calculation.

Figures 2 and 3 clearly show the tax penalty on each additional child in a household resulting from the Minnesota AMT. The difference between each line in figures 2 and 3 in the positive extra tax range is close to $350, which is approximately equal to the 6.75% flat AMT tax rate multiplied by the state dependent exemption of $4,800 per child, which is not allowed in the state AMT calculation.

Figure 2 shows that a married Minnesota taxpayer with $309,000 of employment income, $100,000 of AMT-non-allowed deductions (e.g., gambling losses, mortgage interest) and 7 children would have an extra AMT tax liability of $6,099. Figure 3 shows that a single Minnesota taxpayer with $260,000 of employment income, $100,000 of AMT-non-allowed deductions and seven children would have an extra AMT tax liability of $7,467.

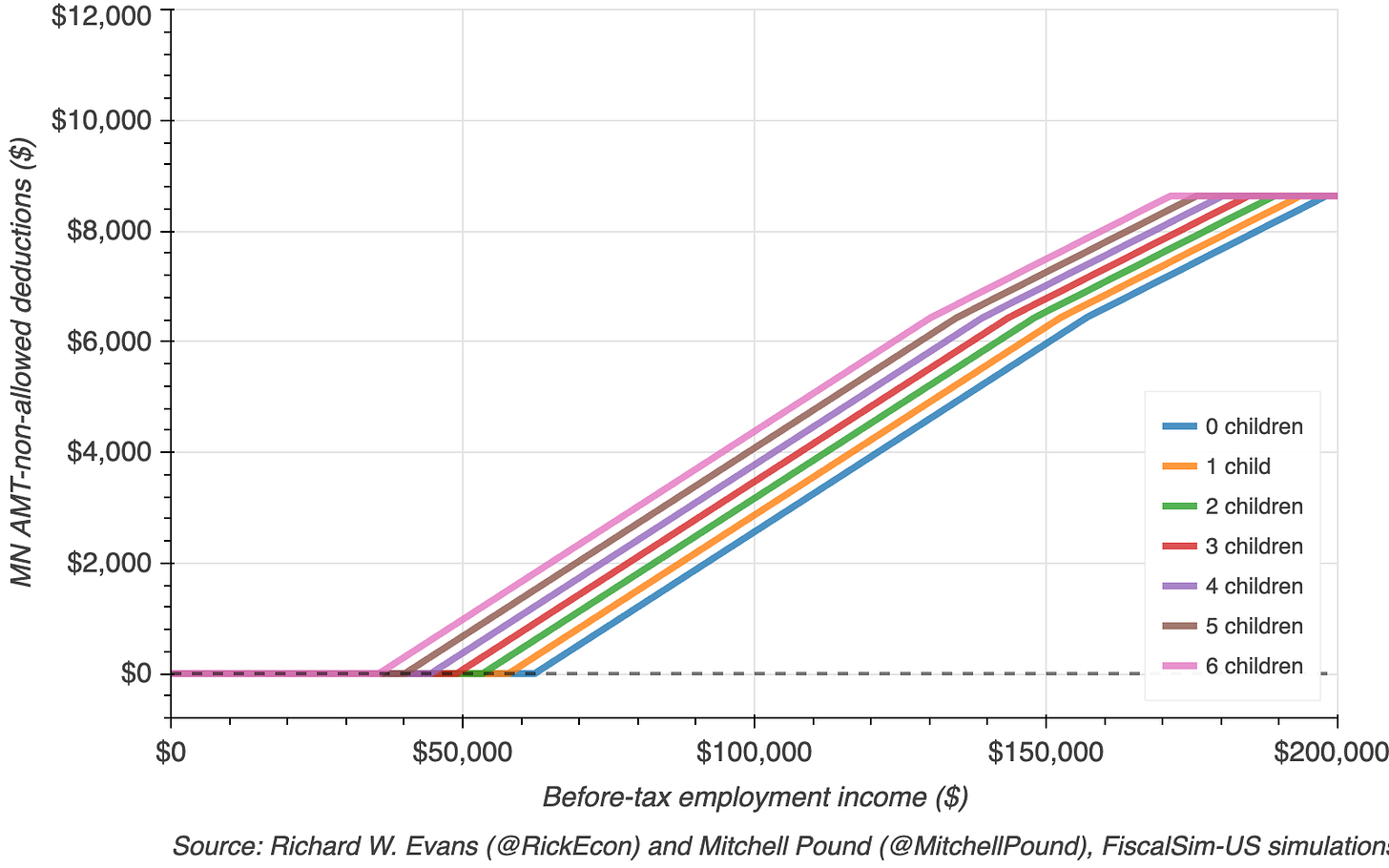

3.2. Scenario 2: Effect of increasing AMT-non-allowed deductions

The other big difference between the state AMT tax liability calculation and the standard Minnesota calculation is the expense and loss deductions that are allowed under the standard calculation but are not allowed under the Minnesota AMT, such as gambling losses, home mortgage interest deductions, state or local taxes, and state or local taxes (income, sales, or property).14 In this second scenario, we fix the employment income of a married tax filer (Figure 4) and a single tax filer (Figure 5) at $200,000. And we show how the extra Minnestota AMT above the standard tax liability changes as the amount of AMT-non-allowed deductions increases.

Figure 4. Minnesota AMT minus standard tax liability for married filers by AMT-non-allowable deductions and number of children

Figure 5. Minnesota AMT minus standard tax liability for single filers by AMT-non-allowable deductions and number of children

We only plot the values of the MN AMT non-allowed deductions on the x-axis up to $200,000 in Figures 4 and 5 because employment income is fixed for all these filers at $200,000, and the standard tax liability does not increase for deduction amounts above employment income. This is seen as the flat line for filers are the top end of the AMT-non-allowed deduction values. The extra child penalty of the state AMT described in the previous section is also evident in Figures 4 and 5.

As the size of AMT-non-allowed deductions increases going left-to-right on the x-axis, the extra MN AMT above the standard tax liability calculation increases. And the extra tax liability increases at the rate of $675 dollars for every $10,000 extra of AMT-non-allowed deductions—the 6.75% flat tax rate of the MN AMT.

The left side of Figure 5 for single Minnesota tax filers is interesting. The extra MN AMT liability above the standard tax liability calculation is positive for zero AMT non-allowed deductions for filers with 5, 6, and 7 children. This means that for single filers with 0-to-4 children, the higher marginal tax rates on $200,000 of employment income in the standard tax liability calculation are greater than the AMT liability that does not allow for the dependent exemption. However, at 5-to-7 children, the lack of dependent credit makes the AMT tax liability calculation greater than the standard calculation.

4. Conclusion

The Minnesota individual alternative minimum tax has existed in some form for the last 47 years. Its stated purpose is to guarantee that high income tax filers are not able to avoid paying taxes by deducting certain expenses, like gambling losses and mortgage interest. However, the Research Department of the state House of Representatives estimated in 2017 that Minnesota’s AMT would raise $23.6 million in that tax year from around 9,500 taxpayers–about 0.2 percent of Minnesota tax revenue from about 0.3 percent of registered Minnesota taxpayers.15

In this article, we used the FiscalSim-US open source microsimulation model of federal and state individual income tax and benefit policy to simulate Minnesota tax liability for different types of Minnesota tax filers. We showed that the Minnesota AMT imposes a significant extra tax penalty on each additional child in households with a wide range of middle-to-high incomes. Furthermore, the state AMT can also impose significant extra tax liability on household with large deductions that are not allowed under the state AMT, such as gambling losses, mortgage interest, and state and local taxes.

Given the degree of extra complexity introduced by the Minnesota AMT, the small number of households to which it applies, the small amount of revenue it raises, and the associated child tax penalty, it is not likely that the Minnesota AMT would pass a cost-benefit test. The MN AMT places costs and disincentives in places that would be hard to justify given the narrowness of its target demographics and the small amount of revenue it raises. If the MN AMT could not simply be removed, it is at least likely that more efficient ways exist of taxing middle-to-high income Minnesota households.

The 80 points by the Denver Nuggets was also the Nuggets season low score. See Landon Haaf, “T’Wolves defense suffocates Nuggets in Game 2 blowout, Denver trails series 2-0”, Denver7 Sports, (May 6, 2024), accessed May 6, 2024.

Mitchell Pound was my research assistant and CGO Fellow during my time at the Center for Growth and Opportunity and is now a graduate student in mathematics at Utah State University. Mitch read all the Minnesota tax forms and coded up the tax logic from those forms into the open source FiscalSim-US microsimulation model of US federal and state individual income tax and benefit policy. Mitch was instrumental in coming up with this topic of the Minnesota Alternative Minimum Tax and helped with the writing of an early version of this article. Mitch presented a preliminary version of the results in this article at the Annual Conference of the Association of Private Enterprise Education on April 18, 2023.

The state individual AMT is differentiated from the state corporate AMT. The four states that currently have a state individual AMT are California, Colorado, Connecticut, and Minnesota. Iowa repealed its state AMT effective January 2023. See Iowa Senate File (S.F.) 2417, 2018, https://www.legis.iowa.gov/docs/publications/LGE/87/SF2417.pdf.

See “Alternative Minimum Tax”, Minnesota Department of Revenue, accessed May 6, 2024, https://www.revenue.state.mn.us/alternative-minimum-tax.

The open source FiscalSim-US microsimulation model of federal and state income tax and benefits simulates the effect of changes in household and personal tax and benefit policy on households in each state as well as on federal and state tax revenues. FiscalSim documentation and its source code is available at https://github.com/TheCGO/fiscalsim-us. All data, analyses, and images in this article can be reproduced using the resources in the GitHub repository for this article at https://github.com/OpenSourceEcon/MN-AMT. The code for replicating the analyses and creating the images can be run locally on your machine using the Jupyter notebook MN_AMT.ipynb or can be run from your browser using resources in the cloud from this Google Colab notebook.

See Tax Reform Act of 1969, H.R. 13270, https://www.govtrack.us/congress/bills/91/hr13270/text.

See Nina Manzi and Joel Michael, “Minnesota Individual Alternative Minimum Tax”, Short Subjects, Research Department of the Minnesota House of Representatives (January 2017).

See Tax Equity and Fiscal Responsibility Act of 1982, H.R. 4961, https://www.govtrack.us/congress/bills/97/hr4961/text.

See Nina Manzi and Joel Michael, “Minnesota Individual Alternative Minimum Tax”, Short Subjects, Research Department of the Minnesota House of Representatives (January 2017).

See Parts I and II of US Internal Revenue Service Form 6251, https://www.irs.gov/pub/irs-pdf/f6251.pdf.

See Nina Manzi and Joel Michael, “Minnesota Individual Alternative Minimum Tax”, Short Subjects, Research Department of the Minnesota House of Representatives (January 2017).

The Minnesota individual alternative minimum tax (AMT) is calculated in the “2023 Schedule M1MT, Alternative Minimum Tax”. The alternative tax on this worksheet is first calculated as a total amount of AMT taxable income and corresponding AMT tax liability in lines 26 and 27, which has different deductions and tax rate from the standard calculation on the M1 standard form. Then the standard tax liability is subtracted from the AMT tax liability, and the AMT tax liability is entered as an extra amount above (not below) the standard liability on line 29 of the M1MT form and transferred to line 11 on the standard M1 form.

The $4,800 income exemption for each dependent in the standard tax liability calculation is stated in the “Worksheet for Line 5–Dependent Exemptions” on page 14 of “2023 Minnesota Individual Income Tax Forms and Instructions”, Minnesota Department of Revenue. The dependent exemption is not included in the Minnesota “2022 Schedule M1MT, Alternative Minimum Tax” for determining tax liability under the AMT calculation, accessed October 16, 2023, https://www.revenue.state.mn.us/sites/default/files/2023-01/m1mt_22.pdf.

See “Alternative Minimum Tax”, Minnesota Department of Revenue, accessed May 8, 2024, https://www.revenue.state.mn.us/alternative-minimum-tax.

See Nina Manzi and Joel Michael, “Minnesota Individual Alternative Minimum Tax”, Short Subjects, Research Department of the Minnesota House of Representatives (January 2017).